Investing in bonds is one of the safest options for every financial investor, even for complete beginners. While there are many types of investment options out there – stocks, mutual funds, real estate, insurance policies, foreign exchange, etc. – bonds are less risky in nature, thus making them a must in a diversified investment portfolio.

When deciding to set aside an amount of money for investment, it is recommended that you create an investment portfolio that is diversified. This spreads the financial risks involved into different investment instruments and therefore creates a healthier financial investment plan. Of course, the options included in the portfolio should depend on one’s goals and objectives. Speak to a financial advisor to get ideas on which instruments to include.

One of the options that you should look into is bonds. By definition, a bond is a debt security issued to raise money for capital. The maturity of a bond is usually set for more than one year. Upon the sale of the bond, the issuer is obliged to pay the holder the principal plus interests before or during the maturity date. This financial instrument provides the investor a source of income in the form of interest paid twice a year. The structure of the instrument makes the holder easily predict the amount of income generated.

Corporations and governments require large amounts of money to fund endeavors. In order for these entities to raise enough money, they sell bonds to investors. As soon as the endeavors start to make money, both sides result into a win-win situation. The corporation or government entity earns profit, while the investor earns interest. However, there is also a small risk involved in this type of investment.

When the company that issued the bond goes bankrupt, they may not be able to pay the interest, part of the principal or the entire principal. This risk can be dealt with by making a sound decision before deciding to invest.

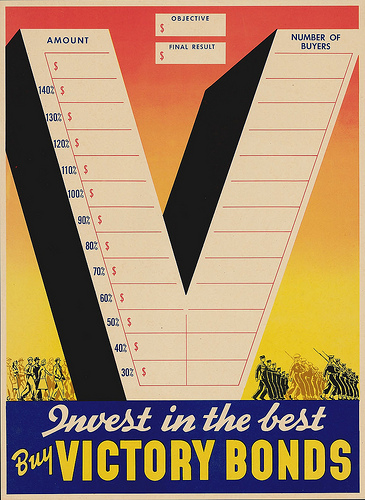

To invest in bonds, first choose which type to invest into by doing some good research on the Internet, reading finance magazines and books, and getting recommendations from financial advisers. After making a sound decision, determine the amount you are willing to invest and purchase the bond through a broker or directly from the company issuing it. The minimum amount of investment is usually $ 5,000. Consider investing through mutual funds if the minimum investment amount is too high for your budget.

Feed yourself with exciting news and information from the Currency Trading News website. This is the place where you can also learn about the tips and tricks done by fellow traders online. You should also take time to check out some Forex Trading Reviews online.

Bonds are investment tools that companies use for loan purposes to break up debt into smaller monetary increments. Invest in bonds, which can come in 10 or 1…

Video Rating: 4 / 5